An Analysis of the Squid Market for the First Half of 2024

Gigas Squid Fishing and Processing

Peru, recognized for its abundant marine resources, has a squid industry that plays a significant role in its economy. However, data from the Ministry of Production indicates that squid production in the first half of this year has been disappointing, with a reported catch of only 140,000 tonnes, reflecting a nearly 70% decrease compared to the previous year. This decline can be attributed to adverse weather conditions following the conclusion of the Peruvian double holiday in early January, which resulted in excessively windy seas that restricted fishing activities. Consequently, local processing facilities were left with limited stocks to work with.

Although fishing activities resumed later, the output remained low, persisting until early June when small-sized squid weighing between 1-1.5 kg began to be caught near Paita in northern Peru. During this period, Peru experienced a surge in orders from China; however, as the specifications for squid increased in size, the overall catch volume diminished. Many processing plants faced challenges in meeting delivery deadlines, leading to temporary shutdowns or a shift towards processing alternative seafood products.

Currently, squid fishing in Peru is largely stagnant, with local factory managers predicting that the next significant catch may not occur until December. The reduction in squid production is expected to have a cascading effect on the international market, particularly impacting China, a key importer of Peruvian squid. The resulting imbalance between supply and demand is unlikely to be resolved in the short term.

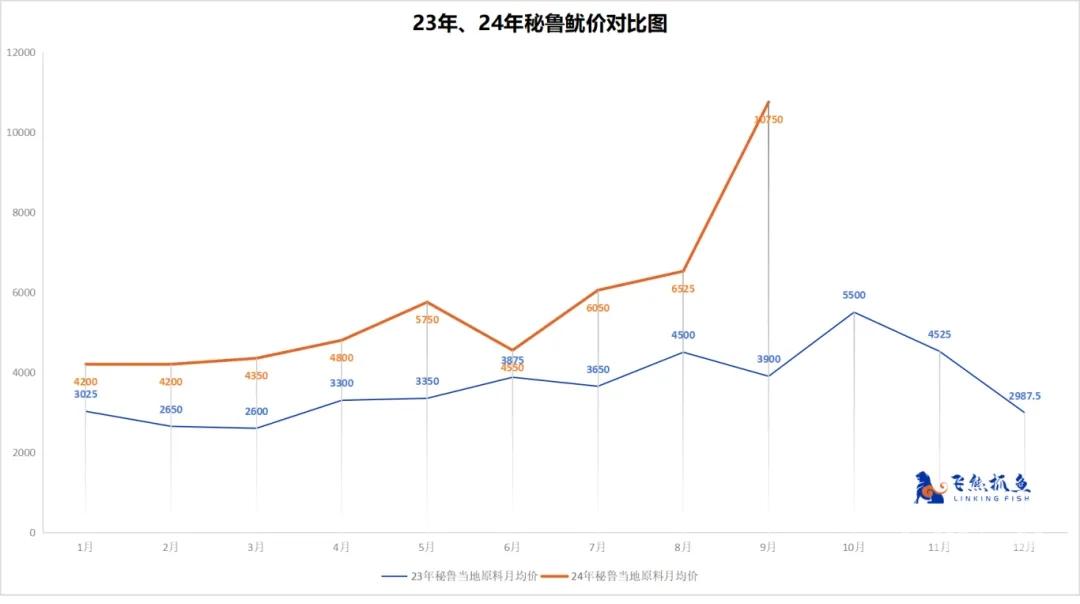

Gigas Squid Prices

The gigas squid stocks are experiencing significant depletion, leading to a pronounced increase in price levels. From January to August of this year, the prices of gigas squid have remained elevated, with the annual average price reflecting an increase of nearly 62% points compared to the same period in the previous year. Notably, during the first week of June, Peru initiated the harvesting of smaller squid varieties, which were priced lower; however, the overall trend for squid prices in Peru has been upward. Particularly striking is the remarkable surge in prices observed in the first week of September, where the current weekly average price has reached 10,750 soles per tonne, marking the highest price level seen in nearly three years.

Summary of the Squid Market

As of August, the annual production of deep-sea squid in China is approximately 600,000 tons, with over 85% being Peruvian giant squid, 12% Argentine squid, and a relatively low proportion of North Pacific and Indian Ocean squid.

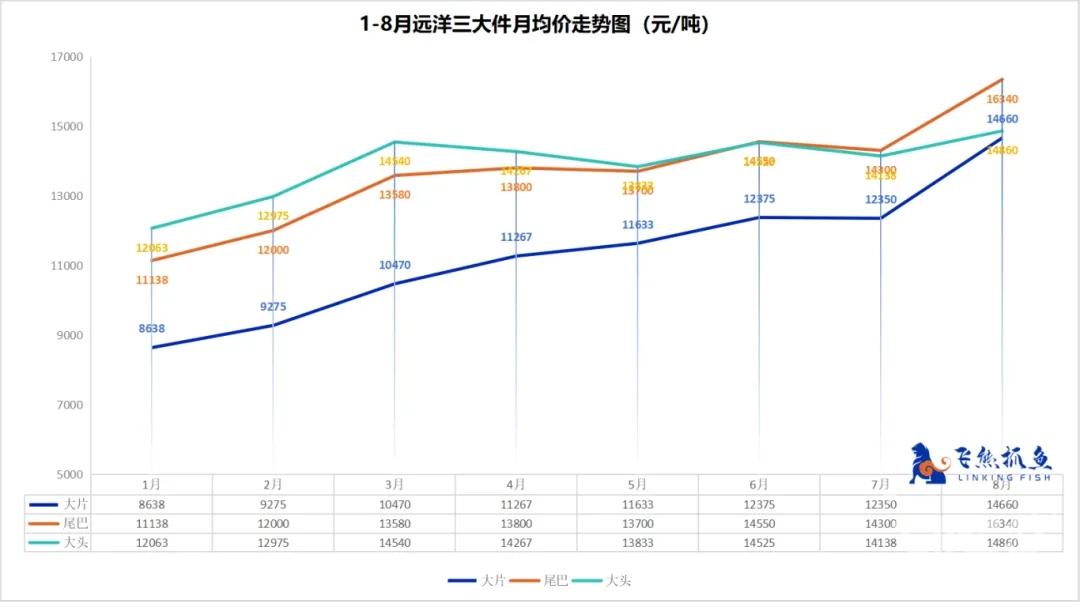

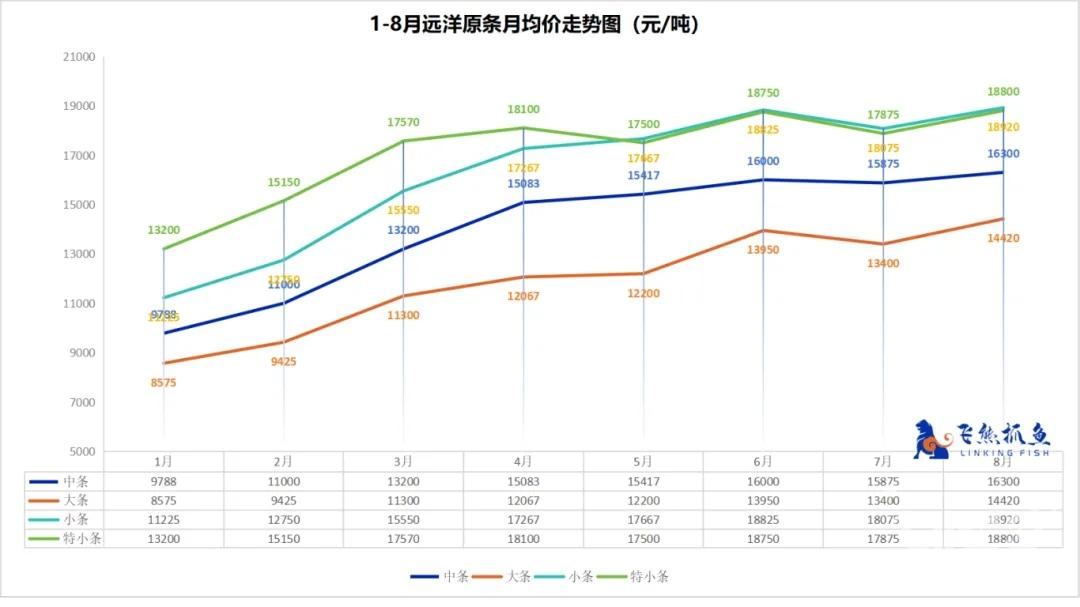

From January to August of this year, while the supply of Argentine squid from the Southwest Pacific region has remained relatively abundant, leading to a continuous decline in squid prices, the price indices for squid from the other three regions have been on the rise, particularly in the Southeast Pacific, where the increase has been most pronounced. The Peruvian squid from the Southeast Pacific holds a significant share in the global squid market, and its production levels have a considerable impact on squid price trends. However, there has been a sharp decline in the production of Peruvian squid this year, which has contributed to the notable increase in prices.

Recently, the global squid catch is still no sign of improvement, the market supply continues to be limited, although the high price of the market demand has a certain inhibition, but the impact is limited, ocean-going squid prices are still running high.